Investors have been enthralled by Singapore’s real estate market, which is centred on the Core Central Region (CCR). Even though recent comparisons indicate that CCR is growing somewhat more slowly than other areas, wise investors still find CCR to be a tempting option. During a recent conversation with a customer, we discovered some fascinating untapped potential in this vibrant area.

This piece will examine the statistics and patterns that bolster CCR’s investment potential and go over the variables that affect buyers’ decisions between newly constructed and resale condos.

Understanding Price Gap Between CCR, RCR and OCR

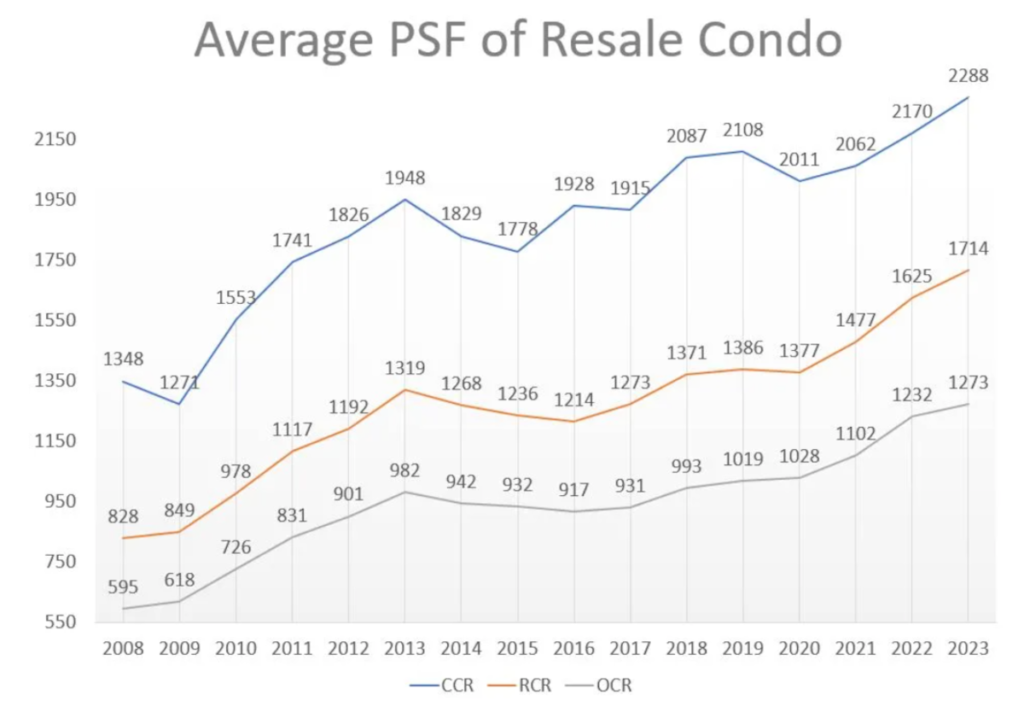

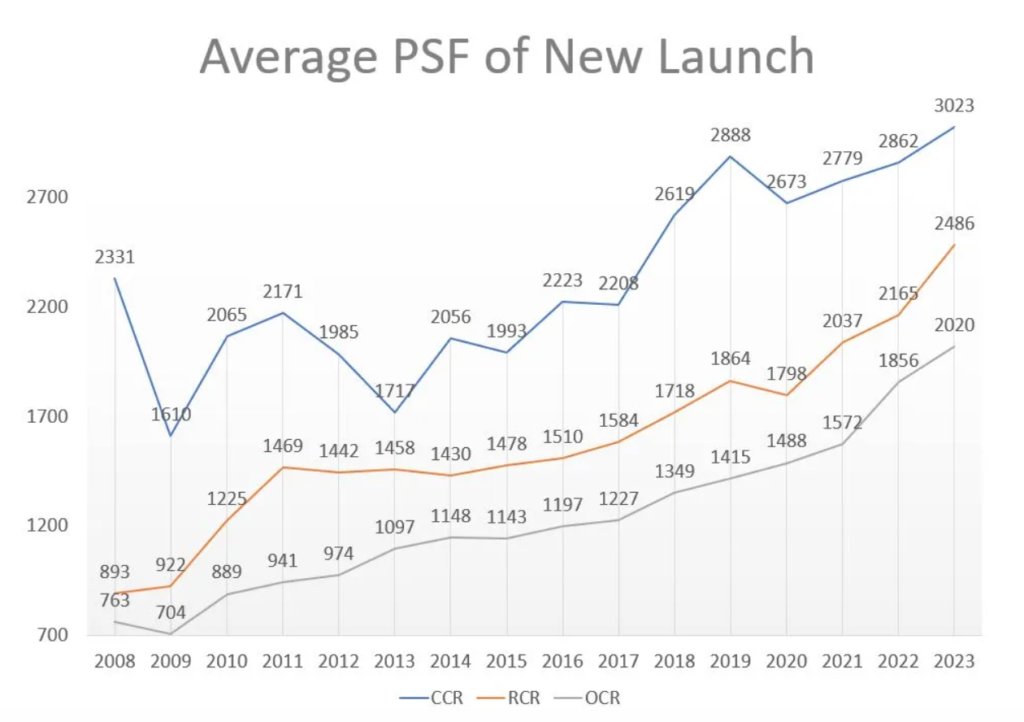

Important insights may be gained by comparing the average price per square foot (PSF) trends for resale condominiums in CCR, Outside Central Region (OCR), and Rest of Central Region (RCR) over a 15-year period.

Primary Market

In the main market, the price differential between CCR and RCR is much larger, having decreased from a 15-year average of 38.73% to 19.50%. In a similar vein, the 15-year average price difference of 62.88% between CCR and OCR has shrunk to 39.78%. These numbers point to a sizable potential profit margin for investments made in brand-new launch properties located in the Core Central Region.

Secondary Market

Over time, the average price difference between resale private condominiums in CCR and RCR has been 39.11%, however the average price difference between CCR and OCR has been 66.79%, which is more considerable. But subsequent price increases, mostly brought on by domestic demand, have reduced the difference between CCR, RCR, and OCR to 28.69% and 57.01%, respectively.

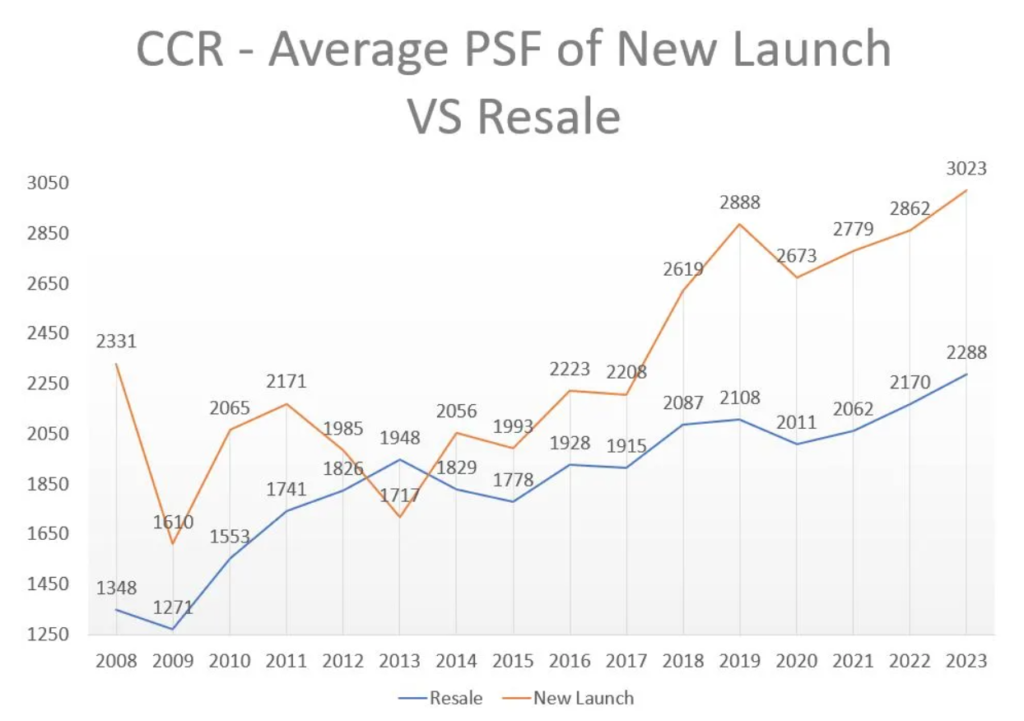

New Launch Versus Resale in CCR Market

The decision of whether to buy new launch condos or resale condos is critical when thinking about investing in CCR. Analysis suggests that when compared to new launches, new launches such as One Sophia can provide a little better value due to the capital appreciation.

Things to Take Into Account

Although pricing gap research identifies CCR investment possibilities, each person’s tastes and needs must be taken into account.

- Urgency: While newly launched projects may take longer to complete, resale condominiums could be better for quick occupancy.

- Preference: Think about whether you like the distinct charm of older resale condominiums or the modern amenities of newer construction.

- Investment Horizon: The length of your investment may have an impact on whether newly launched or resale condominiums are suitable.

In summary

The Core Central Region of Singapore still has excellent real estate investment prospects. Making educated judgements about resale or newly launched condominiums may be achieved by examining the price difference, taking into account personal preferences, and setting investment objectives.

Getting expert advice and doing extensive research are crucial before making an investment in CCR homes. Investing in CCR homes may be profitable and fulfilling if done correctly.